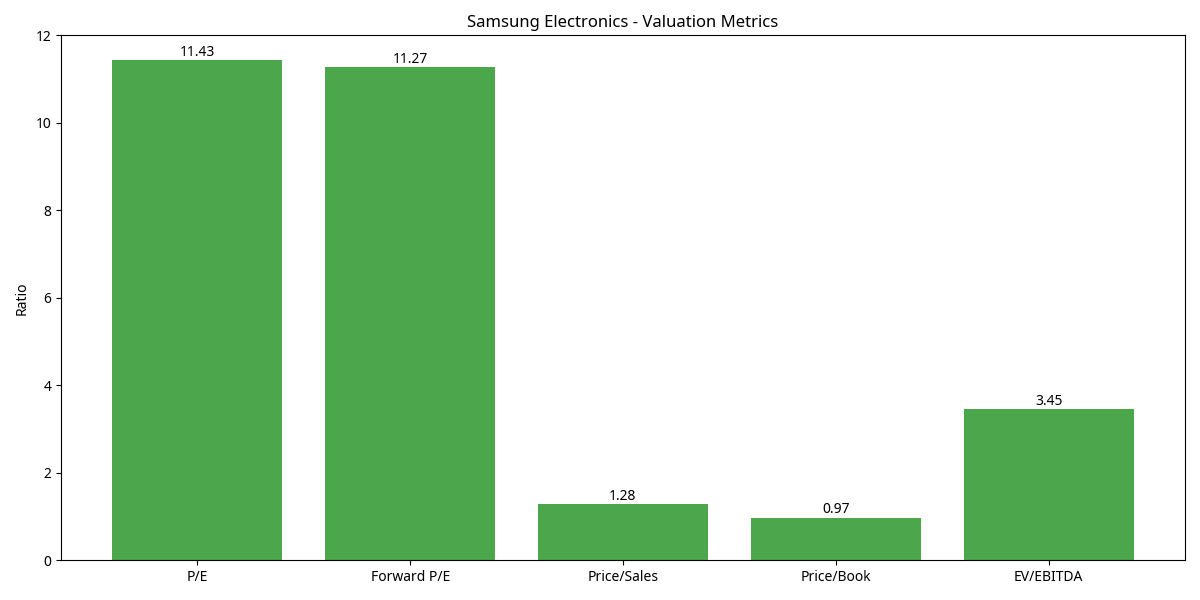

Valuation Metrics

| Metric | Value | Assessment |

|---|---|---|

| Trailing P/E | 11.43 | Attractive |

| Forward P/E | 11.27 | Attractive |

| Price/Book | 0.97 | Below Book Value |

| Price/Sales | 1.28 | Reasonable |

| EV/EBITDA | 3.45 | Very Attractive |

Samsung trades at attractive valuation multiples compared to both historical averages and industry peers. The price-to-book ratio below 1.0 suggests the stock may be undervalued relative to its book value.

Dividend

Samsung offers a reasonable dividend yield with a sustainable payout ratio, providing income potential for investors while allowing the company to retain sufficient earnings for future growth.

Analyst Sentiment

While specific analyst price targets were not available in our data, the general sentiment appears cautious in the near term due to semiconductor market challenges, with more optimistic outlooks for the second half of 2025 as memory markets are expected to recover.

Valuation Summary

Samsung Electronics is trading at attractive valuation multiples, with a P/E ratio of 11.43, a price-to-book ratio of 0.97, and an EV/EBITDA of 3.45. These metrics suggest the stock may be undervalued based on fundamentals alone.

However, near-term challenges in the semiconductor business and competitive pressures in the smartphone market may limit upside potential in the 4-6 month timeframe. The dividend yield of 2.65% provides some income while investors wait for potential recovery in the second half of 2025.